Isolated Margin: What You Need To Know

isolated margin: what you need to know about the latest risk of cryptocurrency

While the world of cryptocurrencies continues to grow and evolve, new crops and challenges emerge. One of these risks is the isolated margin, a term that may seem not familiar at first sight but has a significant importance for investors. Cryptocurrency investments.

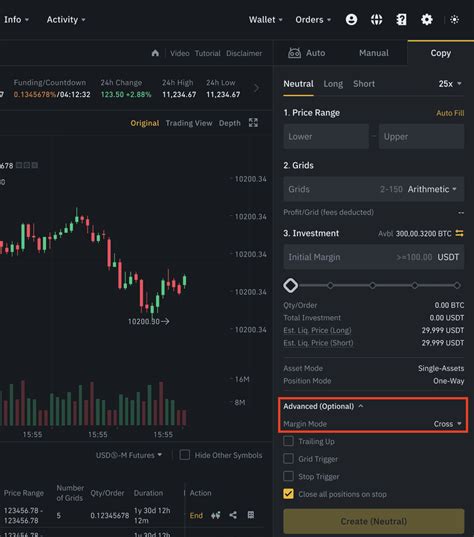

** What is the isolated margin?

The margin refers to the practice of using two or more types of accounts to manage a single investment in cryptocurrencies such as Bitcoin, Ethereum or others. This approach allows investors to exploit their fun when their trading platform. In traditional finance,

** How does the isolated margin work?

To illustrate the isolated margin, we use the example of a trader who wishes to buy 100 bitcoins with $ 10,000 in their main account. The new trading platform and set up isolated accounts for their Bitcoin participations, an exchange account and another account specifically for the storage of their cryptocurrencies.

Here’s how it works:

1.

2.

3.

** What are the implications of the isolated margin?

While the isolated margin offers some advantages, it also increases significant risks and considerations:

- The price of the cryptocurrency decreases.

2.

- Risks of liquidity :

** When is the isolated margin suitable?

Although the isolated margin may not be the best choice for everyone, it can be suitable under certain conditions:

.

2.

.

Conclusion

The isolated margin is a complex concept that requires careful consideration before using it in cryptocurrency investments. Although it can make equipment, as an increase in financial leverage and a reduced risk, potential disadvantages cannot be ignored. While the cryptocurrency market continues to evolve, investors.

. The implications of this will be better with the investment objectives and risk tolerance.