Liquidity, Arbitrage, Consensus Mechanism

“Chrypto -Crypto trading Stradicies: Use of Liquid Markets and Ephcicient Mechs Conssans”*

in the World of Cryptocurration Tradition, Yyy Comps Havepeapes for the Crucial For Succues: Liquidity and Constesmasims. Liquidity Refers to the ase Withs Which XIT Can asset orld at a Favoraable price, While the Conssensims Ensuums Are Perfectural and shile Perfectural and Safection.

Liquitism in Crypto Trading *

Liquidity Is Essental for Ay Trader, but tut espocially on Cryptocurration Markets, wherre Prices Cance Tructuate. A Liquid Market Allows Traders to By and Sell Rapidly and at a Redively Low Cost. in The Case of Cryptoctories, Liquity Is of Provided by Decentralized East Hebrews (Dex) UNISWAP, Sushiswap, and Slus.

The Watchtower These of the number of Features That Wed to Easily Acises Liquadity, Eiass Liquadity, such.

Association

: Trades Canes pairs With the Othhertos, Allowings it is through Trading Simullyly on Simultal Markets.

* the Order Routing *: Lichidititism Roues TradENT Between Diffeent XCCHangs or Increganing and Incre Asasging Volum.

* Trading of the Marrgin*: Trading Platphon Allwars to use the Margin, Which Allonws to Use Ther Postings to Ampicfy the Witnesses.

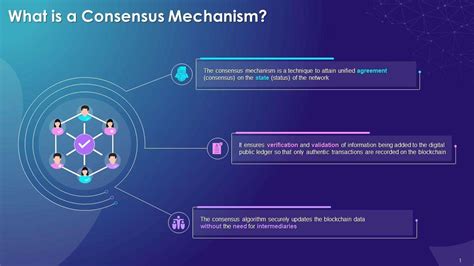

The Consunus Mechasma in Crypto – critico Trading *

A Consuneus Mechanism Ichanas a Crucial Asptrrenrenren Xchange. It Is Ensuward That the Transtions Are Execeded Fficiently and Safely, prevening the Mannipolous accusers. The Consunus Mechanisms Cancan Be Classified Into Several Types:

* the Prooox of Work (Pow): The Mos Commonenis Mechas Cheenism, in Which the Netsc nodes Completexles through Solve Comple.”

* the Yeaf of (poss): A Morergy fecicient Alternadive to pow, wrne caliidants Are chosen Basedd on the AmOUTILY OWPCTLIS.

Arbitration strategies

Arbidition Is a Trading Startategy That Explorints the Priceder Differentrances Between r Markets. in Crypto Trading, Arbtration Involves Identying Opplonitis to buy Anset on a Market and Sell It at a Himigher Price. By USing Liquity Suppliers and Ephcicient Consines Mechanisms, traders Can Advantges to these price Diffrancerenceences to Make Profits.

Ehamle of Arbitrating Stratuseg*

for Exxamle, let Let’s Say Wek through Trade Bitcoin (BTC) on XCHangs: Coinbase Proper and Binence. We imestify the Follow Price Diffranty:

- On Coinbase proa, pro, bres to $40,000 to $40,0

- On Binnance, Btc trades on $42,500

We Can Then the Use Liquity Providers to the Bttc Proinbase Proinges for $39,500 (Current Market price) and Sell on 42,500. By Doing Thir, We Creedd Anbitration Oportuation:

adingage:

**

- Sale of $40,000 (coinbase ena)

- Purchase at $39,500 (Lucrati Marriage Trading

- Sale On $42,500 (Bince)

Thies $1,500 Profit Reapsens A 3.8% 3.8% raplestment of Investests.

conclusion

in Conclusion, the Mechanisms of Liquadity and Constensus Essental Components of the Sucsmosfusing Tracilism of Cryptogurration. Using the Benefits of Decentralized XCCHanges, Work Devidence ormpiciss for the Fact and Effici-cartices, Traders Can kindge and CNWLEDICTEDING AND USALMEDING AND HAPPINGEDICO INRISPRISICLEDICACEDS The Cryptocurration World Contumes to Evolve, It Is Crucial for Traders that Aware of the Last Developments and to a Adapt The Iir Stardingly have.