Reading Candlestick Charts: A Beginner’s Guide

Reading Candle Cars: Handbook for beginners for cryptocurrency trade

Crypto currencies like Bitcoin and Ethereum have been becoming more and more popular in recent years. However, even for experienced investors, navigation with the complex world of the Krypto -wave can be huge. One of the tools that proved to be a precious trader resource are candlesticks. In this article, we will explore how to read candlesticks and use them to inspect the movement of the prices of cryptocurrencies.

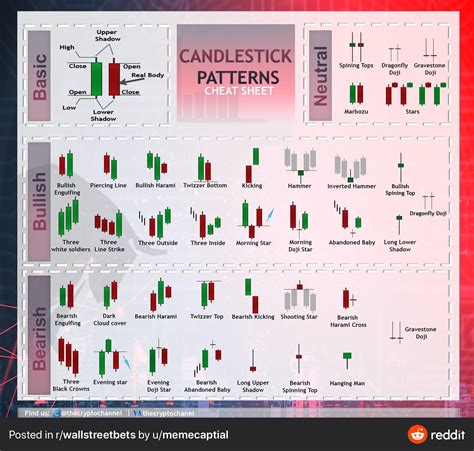

What are the candlesticks?

Candlestick diagrams are a type of designs for a chart design used in a technical analysis for visualization of price movement over time. Each candle indicates the prices of opening and closing a certain period of time, as well as any open interest (number of unpaid units). The size and color of each candle indicates the movement of prices.

Candlestick types

There are several candlesticks, but here are some of the most common:

* Hanging hammer : candle formed when the price price is below the initial price.

* Inverted Hammer : A candle formed when the final price is higher than the starting price.

* Dreamed : A candle that forms a small body with a long tail, indicating indecision or lack of belief in the market.

* Shootal Star : A candle formed at the end of the action down, pointing to a possible speed.

Reading a candlestick ladder

To effectively read the Captick maps, it is important to understand the following:

1

Open and closed prices

: These two prices reflect the opening and closure values every day.

- Corps Candle : The candle body over time indicates the movement of prices.

3

Fittile length : The length of the wick on both sides of the candle indicates the movement of prices.

Interpretation of a candlestick model

Here are some usual candlesticks and their interpretations:

* World model 1 (hammer) : a strong trend up with a small body.

* candles 2. Model (reverse hammer) : a strong trend down with a small body.

* Easter 3. Model (breasts) : a balanced market without a clear trend.

* Model 4 (shooting star) : Downland with a weak or unconvincing turn.

Using candlesticks to recognize the model

Here are some ways to use candlestick cards to recognize the patterns and provide the price movement:

1

Look for speed models : When the price forms a cropped model, such as a hammer, a trimmed hammer, a breastfeeding or a shooting stars, this may indicate possible changes in trend.

- Determine changes in trend : World points can help you determine when to buy or sell on the basis of changes in the trend.

3

Use a candlestick samples to confirm the chart signal : many chart signals, such as breaking and turning, require a certificate from a candlestick samples.

Tips to read candlestick scales

1

Exercise, exercise, exercise : the more you exercise to read the candle tickets, the better you will become to interpret them.

- Focus on the candle body

: The candle body is often the most important part of the chart as it reflects the movement of prices over time.

3

Use a few deadlines : candlestick cards have to understand several deadlines, such as short and long -term trends.

Conclusion

Candlers cards are a powerful tool for merchants who can analyze the cryptocurrency market. Learning to read and interpret these maps effectively, you can get an insight into the movement of the prices of cryptocurrencies and bring more informed trade decisions. Keep in mind that candlestick samples can be used to identify speed points, confirm the chart signal and prediction of changes in trend.